1-in-5 New-Car Buyers Are Throwing Down 4-Figures per Month Like It’s Nothing

Buckle up—when you’re driving and as you read this post—because according to Edmunds, a jaw‑dropping 19.3% of new‑car buyers committed to monthly payments of $1,000 or more in Q2 2025. Nearly one in five shoppers just shrugged and signed on the dotted line like it was grocery money. That’s up from 17.7% in Q1 and 17.8% this time last year.

Want more proof today’s buyers are financially skydiving without a parachute? 84‑month+ loans now account for 22.4% of new‑vehicle financing—up from 20.4% in Q1 and 17.6% a year ago. Average amount financed hit $42,388, while 0% APR deals dropped to a record‑low 0.9%.

Folks, we are financing cars like we finance college. At least those come with diplomas—these just come with infuriating touchscreen climate controls and 80 different ambient light colors!

Shoutout to the Real MVPs: New‑Car Buyers

Let’s take a moment to honor the true heroes out there—those who buy new cars and absorb the depreciation like it’s their civic duty. Seriously. Statues should be built. Their names should be etched into dealership walls. They selflessly lose thousands in value the moment the car leaves the lot so the rest of us can scoop up used cars at a discount a year or two later. Thank you for your sacrifice.

(AI-generated image, since I know for a fact my dad would think this is real)

If you’re not into torching money, though, let me be your certified pre-owned evangelist.

CPO cars typically give you most of the new-car peace of mind—multi-point inspections, warranty coverage, and usually a full history of careful ownership—without that instant depreciation gut punch. A little more expensive than traditional used cars? Sure. But worth it? Absolutely.

The Highlander Story: A Long, Responsible Road to Smart Financing

When my wife and I were in the market for a Toyota Highlander, we were targeting that sweet spot of age, mileage, and trim. Most certified models meeting our criteria in the Southeast were priced between $40,000–$45,000. With a typical 20% down and an APR in the 6.5–7% range, we were staring down a $700+/month payment.

For context: my first car payment was $350/month. My wife’s first car? Less than $300/month. So even though the $700 was technically affordable for us, we both refused to agree to those terms. Just because you can afford it doesn’t mean you should.

Right as we were putting in an offer on a house, my wife’s 2012 Ford Edge Platinum died at a little over 165,000 miles. And we knew better than to buy a house and a car at the same time. So we made the call: hold off. For six months, we shared my measly TLX sedan, moved across state lines, and leaned heavily on the generosity of friends and family who loaned us cars when needed.

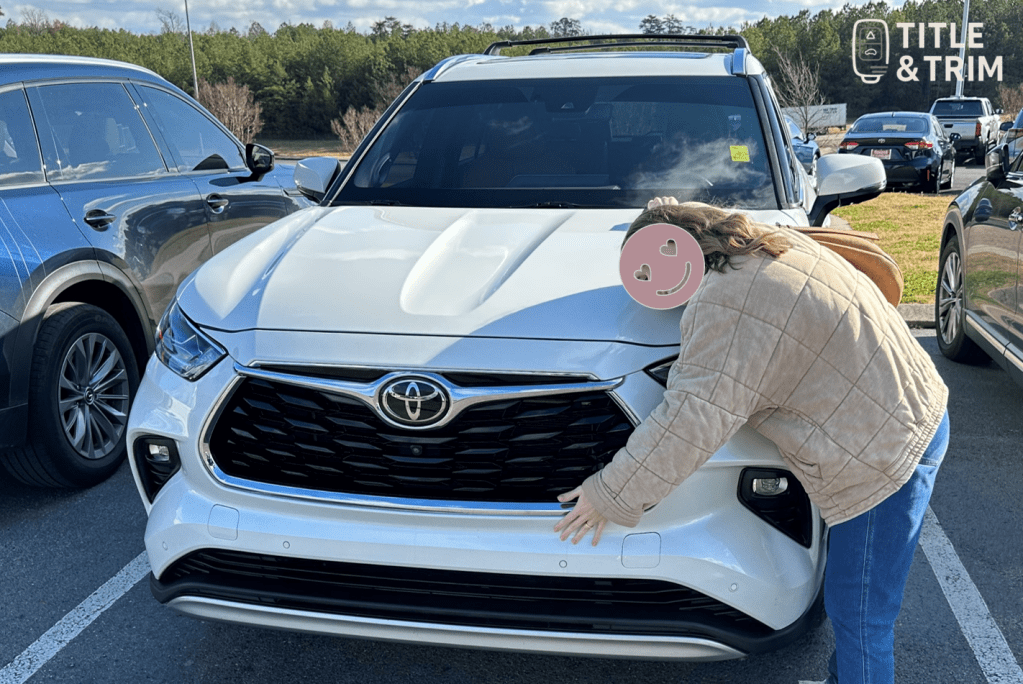

Then came the news in early-November: we were expecting our first child. Suddenly, the Highlander wasn’t just a want—it was a necessity. Something mom-worthy. And ASAP.

In that six-month span, every Highlander we test drove had deal-breaking flaws or was scooped up before we could even get to the dealership. It was brutal. But we kept saving. In the end, we scraped together a down payment of around $18,000.

Finally, the unicorn appeared—just outside of Chattanooga, Tennessee at Toyota of Cleveland. Massive shoutout to Kenny, who gave us an awesome dealership experience.

We placed a $1,000 deposit the day it was listed, drove up that night, and sealed the deal the next morning. Final price: $45,000 out the door. We financed $27,000 at 5.7% over five years. That brought our monthly payment to just under $530. Manageable. Comfortable. Not soul-crushing when compared to $1,000+! And it gives us the flexibility to pay more towards the principal each month if the budget allows.

Don’t Buy a Car Like You’re Buying a Home

Please, if you take one thing from this blog: don’t normalize $1,000/month car payments. Don’t sign up for 7- or 8-year loans on something that’s literally designed to lose value.

Because the moment you stretch yourself thin, one unexpected medical bill, job loss, baby formula recall panic buys—and boom: your credit tanks. A repossession haunts your credit report for years. And for what? A heated steering wheel?

This Isn’t A Dave Ramsey Lecture—It’s An Honest Plea

Let me be clear: I am a Dave Ramsey listener, not a disciple. My wife and I manage our money well and in a way that works for our family, but we never planned to buy our house or primary vehicles with cash.

Now, when it comes to our kids’ first cars when they turn 16? Yeah, those will be bought outright. No interest, no monthly drain. I’ll even buy a bow to put on top.

Also: we will never carry two car payments at the same time. That’s our rule. Married readers, take note.

I understand that cars are getting more expensive—especially as more tech and features creep in—but at some point, we have to step back and say: this is f*cking nuts!

We need to stop acting like paying over $1,000 a month for a depreciating asset is just the way things are. It’s not. And it doesn’t have to be.

Oh, And One Last Thing…

My mission with Title & Trim is to help empower potential car buyers—especially those who have never purchased one before or those who maybe aren’t as auto-market savvy—to make smart decisions when deciding what piece of metal they’ll be moving for the next however-many years. If you’re considering a vehicle purchase or just have questions and would like an automotive nerd’s take on the matter, please DM me on Instagram @TitleAndTrim or send an email to info@titleandtrim.com. I’ll respond as soon as I can.